Doctors, Lawyers, Patients and the UF Self Insurance Program

They’re everywhere: bus wrappers, television, radio, billboards and stickers on the local newspaper. Yes, you guessed it — I’m referring to ads for plaintiff’s attorneys.

A few weeks ago, I was in a hotel where there was an old-fashioned yellow pages with several tear-away strips on the cover informing me that a named attorney, with a toll-free telephone number, would give me free consultation in home or hospital for “all types of accidents and medical malpractice.” The logo of a speeding car left me in no doubt that a lawyer could be with me in a moment’s notice. His sticky advertisement promised: “We stick with you.”

No doubt, our nation should have a fair system in which patients who develop significant complications from negligent medical care should receive appropriate compensation. From the vantage point of health care professionals doing their best to help patients, however, the idea of lawyers soliciting potential litigants who experience a complication is irritating to say the least.

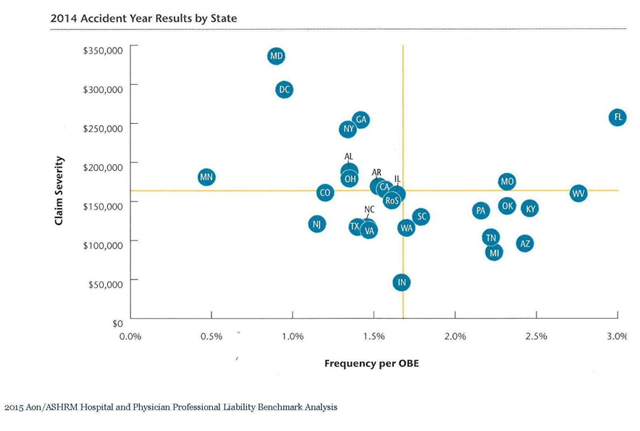

In Florida, the environment for litigation involving health care claims is the worst in the nation. This can be seen in the graph below, which shows data by state for the year 2014. The X axis is the frequency of malpractice claims per hospital bed (technically per “OBE” or “Occupied Bed Equivalent — a standard measure of overall professional liability risk) and the Y axis is the average dollar amount paid per claim (“average severity”). The total expenditure on malpractice claims per hospital bed can be thought of as claim frequency times average severity. The bottom left quadrant shows states with low average severity and low claim frequency. Florida can be seen in the upper right quadrant, with claim frequency and average severity that are both the highest in the nation.

Where expenditures on malpractice claims per bed are high, it stands to reason that professional liability insurance premiums would also be high. In Florida, insurance premiums have risen to levels such that many physicians in certain fields, such as obstetrics and neurosurgery, simply can’t afford the premiums and “go bare.” That is certainly a risky — and stressful — way to practice medicine! And there are also personal implications, such as living one’s life without being able to accumulate assets. That is, to avoid having significant financial assets that can be recovered in a lawsuit, many physicians who practice without insurance coverage pour a disproportionate share of their assets into a home (which is subject to legal protections against recovery in settlements or jury verdicts) and transfer remaining assets to others, such as their spouse.

Listen to the president of a major medical association: “Tort law reform is a crucial issue…and it would not be an overstatement to say that the situation has reached the boiling point. Over the past 18 months there has been a growing chorus of calls for the AMA to work with government to do something to address the blow-out in medical indemnity premiums. We have reached a situation where clinicians in a number of fields are obliged to carry an unrealistic premium burden. This cannot be sustained on a long-term basis.” Of note is that the above quotation is taken from a speech a few years back given by the president of the Australian Medical Association. Professional liability for health professionals has become a problem in every part of the world where the common law system of recovery for torts (civil wrongs) brings doctors and lawyers into litigious conflict.

The plaintiff’s bar, of course, has a different viewpoint. High malpractice premiums do not reflect a large number of claims brought by patients solicited by plaintiff lawyers, nor by high jury awards, nor by the absence of caps on verdicts, but rather are due to the imposition of higher malpractice premiums by insurance companies to make up for low investment performance. As an example of this thinking, here is an excerpt from a 2003 speech given by Alfred Carlton Jr., then president of the American Bar Association: “The fact is, a 50-year review of the investment cycle indicates that every time investment returns decline, (malpractice) insurance premiums increase. The fact is, there is no credible evidence available to demonstrate any variable other than investment returns that affects insurance premiums.” As you can imagine, statements from the Trial Lawyers Association are along similar lines, but more vitriolic.

When a significant complication occurs in medical practice, doctors, lawyers, patients and their families bring different perspectives to the episode. Patients who suffer from a significant medical complication as a result of negligent care should be compensated appropriately. Every case has its own complexities, and all parties have understandable concerns from their vantage point. Complex problems rarely yield simple solutions. Nationally, there are ongoing debates about a variety of approaches. Locally, however, we must deal with the realities of the current system in real time. Over the past 45 years, the University of Florida has developed a self-insurance program (“SIP”) for professional liability that is a model for the nation. In the July 28, 2011 edition of OTSP, titled “Improving Patient Care and Reducing Medical Liability Litigation Using Pre-Suit Mediation,” I presented the early mediation component of SIP. In this newsletter, you will learn more about the history, milestones and future plans of this remarkable program.

UF SIP established in 1971: By 1975, all commercial malpractice insurers exit FL

Florida’s medical malpractice difficulties first threatened professional liability protections for UF in the 1960s. By 1967, the commercial casualty insurance industry grew especially concerned about the state of Florida. Indeed, many insurers left the state and the UF health center experienced a doubling of yearly premiums from 1967 to 1970. By 1971, the University of Florida and the Florida Board of Regents (the predecessor to the Florida Board of Governors) responded to this crisis with a novel solution: establish a self-insurance program, or SIP, for UF health professionals.

In 1971, The Florida Legislature and Florida Department of Insurance approved proceeding with the UF SIP, which became one of the first (if not the first) academic SIPs in the country. The road ahead was not easy, however. The SIP gained approval with startup capital of $500,000, which was funded 60 percent by the UF health colleges and 40 percent by Shands Hospital. Because self-insurance does not allow for the transfer of risk to third parties like commercial insurance, the state of Florida, the Florida Board of Regents, the Florida Department of Insurance, the Florida Legislature and, certainly, UF administrators approached the early years of SIP with healthy caution but strong optimism. UF soon hired a well-respected insurance executive, W. Martin Smith, who was well-known at UF from his handling of claims with the early commercial carriers. Martin Smith was the founding director of SIP and capably led SIP with tremendous vision and success from 1975-2012; he remains one of the most respected thinkers on the subject of academic self-insurance. The Smith small grant patient safety loss prevention program you may have heard about is named for him as a way to remember his lifelong focus on improving patient care and avoiding claims. The forethought in establishing the UF SIP was especially appreciated in 1975 when all malpractice insurers left the state!

Early SIP challenges: ensuring solvency and occurrence coverage protection

What is the biggest concern about any new self-insurance program? Answer: remaining solvent. Solvency ensures that sufficient funds exist to compensate deserving patients as well as sufficient capital to vigorously defend providers when the care was appropriate. Solvency is enhanced by two factors. First, the amount of claims paid in a given year should be less than the amount of premiums collected. And second, as reserves accumulate, year after year, investment performance should help the reserves grow. This was accomplished in the early years, which has now led to an SIP program with significant financial strength.

Such financial strength is very reassuring when one considers that the volume of risk protected by UF SIP has grown dramatically. The hospital portion of the risk alone includes covering over 80,000 annual admissions, over 170,000 emergency visits, 12,000 hospital employees and more than 1 million outpatient visits. SIP also protects over 80,000 student general and mental health-related visits, and the hundreds of clinics and patient research activities performed by the faculty, residents and students of the colleges of Medicine, Pharmacy, Nursing, Public Health and Health Professions, Dentistry and Veterinary Medicine, and the UF Health Proton Therapy Institute. In addition to the volume of risk protected, SIP issues the most comprehensive professional liability coverage available, known as “occurrence-based coverage.” Occurrence coverage is especially important in academic settings as it protects providers regardless of whether a claim is asserted this year, next year or in five years. In contrast, “claims-made coverage” is limited to coverage for claims made during the policy year, is much less expensive and less comprehensive, and is loaded with high residual costs once the policy ends. Private markets generally only issue claims-made coverage.

Florida Legislature and courts protect FL medical education/teaching hospitals

The steady leadership of UF SIP, combined with a supportive Legislature during the next 45 years, allowed UF SIP to remain solvent and grow to accommodate increasing volume. By 1980, the Florida Legislature amended an important Florida law to state: “No officer, employee, or agent of the State, or any of its subdivisions shall be held personally liable in tort or named as a party defendant” if acting within the course of employment. The appellate courts of Florida in subsequent years have upheld this law as crucial for the teaching, research and service missions performed by so many faculty, residents and students at the University of Florida and the other universities throughout the state. It’s important to remember, however, that this law still allows for patients to make claims when dissatisfied.

The claim, however, must be brought against the university rather than individual health care providers. UF SIP provides protection of $300,000 per occurrence (with unlimited aggregate protection) as well as additional protection up to $2 million if the Legislature awards payment of a higher amount after an adverse verdict. Florida law only requires private physicians maintain coverage of $250,000/$750,000 or choose to go bare if certain asset conditions are met. The Florida Legislature’s $300,000 limit per occurrence fairly balances the need to compensate patients with meritorious claims with our state’s need to ensure professional liability coverage remains available and affordable.

The 1985 FL malpractice crisis: more tests for UF SIP and UF Health

By 1985, commercial insurers like St. Paul that had re-entered Florida were requesting a 30 percent rate hike to be approved by the department of insurance. In 1986, St. Paul and others again left Florida. While UF Health had SIP protection now, the affiliated teaching hospitals throughout Florida were struggling and began prohibiting university residents from being trained in their hospitals. The risk of not training the next generation of providers was too high, but the private affiliated hospitals feared they may share liability for the state university residents. Again, UF leadership, SIP, the FMA and the Florida Legislature saved Florida medical education by passing a law that protected private affiliated hospitals from shared liability for care provided by a state employee.

Unfortunately, this was not enough comfort for private insurers or private affiliated hospitals. Thus, the Legislature passed another law, which remains key to this day, to ensure that third parties are not responsible for the actions of state-employed health care providers. The law protects third parties such as affiliated facilities from liability for a university employee if the facility gives patients notice upon admission that they may be treated by “an employee or agent under the control of a university and the health care facility provides to the university a clinical setting for health care education, research or service.” Florida medical education again survived after these added legislative protections but not without a tough struggle.

After the 1985 crisis resolved, UF proactively planned for the future by creating a captive University of Florida Healthcare Education Insurance Company, or HEIC, domiciled in Vermont. HEIC is regulated by the laws of Vermont and managed by a HEIC board, and is an important vehicle for accessing excess coverage protection (i.e., beyond the $300,000 per occurrence) for UF Health employees. The UF SIP achieves excess coverage protection at rates 80 percent lower than another academic self-insurance program in Florida and UF rates are 50 percent lower than similar-sized academic health centers in the Southeast. Finally, in the early 2000s, as other medical schools began to emerge in Florida, the UF SIP helped create and now administers the self-insurance programs for FSU SIP, UCF SIP, FAU SIP and FIU SIP.

UF SIP: since 2011 and the days ahead

So how do the UF SIP premiums required for solvency compare with Florida commercial insurers? Each year an independent actuary determines the necessary SIP funding by taking into account loss history, growth by specialty, facility growth by region, etc. The UF SIP 2015-2016 premium per ob/gyn physician costs $5,287 for SIP coverage up to $2 million. The Doctors Company, a private insurer, charges $109,230 per ob/gyn physician for coverage up to $1 million.

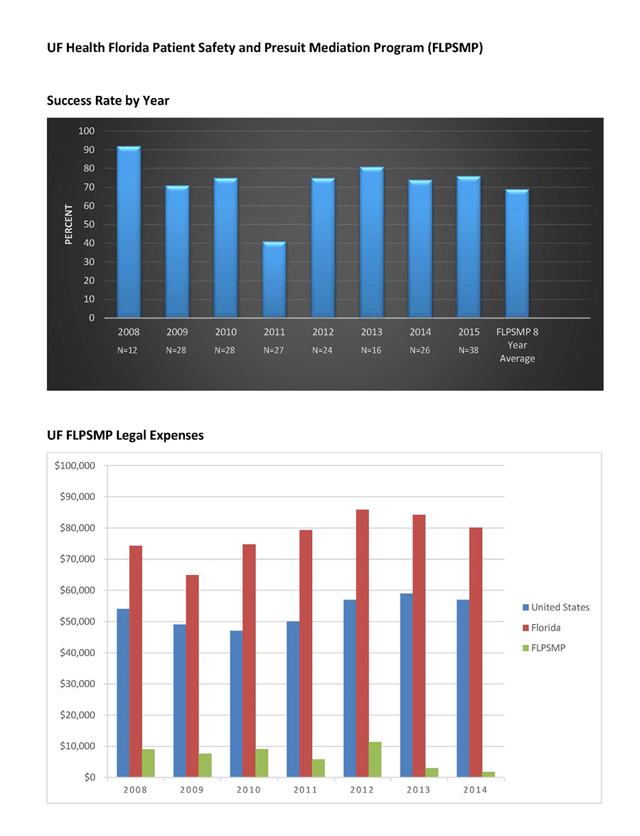

UF SIP has managed to keep premiums affordable because providers and administration let SIP know about possible exposures in real time. Timely reporting allows SIP to resolve potential claims proactively, well before a lawsuit, nearly 70 percent of the time. In fact, the UF pre-suit mandatory mediation program, or FLPSMP, launched in 2008 resolves claims within six months and without the 56 percent to 78 percent of each indemnity dollar consumed by legal fees and costs in traditional litigation. Thus, FLPSMP averages $6,911 in legal expenses to resolve a claim, compared with the state of Florida average defense cost of $80,100. UF SIP has used FLPSMP to help reduce SIP annual legal expenses by about $1 million. (See FLPMSP graphs).

UF SIP is involved in many other areas, outside the scope of this newsletter, where SIP helps current and past UF Health providers. For example, the underwriting and insurance professionals within SIP issue over 4,000 certificates of protection, coverage confirmations and claim history requests to providers and requesting institutions each year. Also, our education and loss prevention professionals contribute to peer-reviewed journals regularly and taught 100 in-person medical legal lectures this past year. The SIP lecture of how to disclose an event continues to be a favorite. During the past year over 1,200 SIP providers received the free continuing education benefit of online SIP medical legal training courses and an additional 600 health care providers from all over the USA learned from SIP online training. Perhaps most importantly, SIP partners with its participants to continually improve through programs such as patient safety organizations and the Smith loss prevention patient safety grant programs.

As word spreads about UF SIP results, others have asked SIP to help them develop a SIP or for help replicating a piece of the UF SIP. Because of the strong UF Health leadership support, SIP staff are the starting point for these accomplishments. The dedicated staff help patients and providers during some of their toughest life moments. SIP phone calls rarely bring good news. But much like UF SIP history, SIP works to foster good things from difficult experiences. Florida laws and rules governing SIP further help by protecting the SIP-provider conversations and materials with strict confidentiality for perpetuity. This confidentiality promotes candor, important evaluation and reflection, and if appropriate, resolution. A solvent self-insurance program timely resolves meritorious claims while powerfully defending unavoidable complications patients experience. A solvent and successful self-insurance program balances these competing perspectives while supporting the dejected health care providers who suffer along with their patient. These often unpredictable complications happen to all of us in life. The UF SIP history, challenges and successes remind all of us how adversity, when handled the right way, helps us emerge stronger than ever.

The Power of Together,

David S. Guzick, M.D., Ph.D. Senior Vice President, Health Affairs President, UF Health

About the author